This post may contain affiliate links. Please read my disclosure for more information.

With so many options to pick from in the stock market, making informed decisions can be the key to unlocking your financial goals. The choice between two great ETFs such as SPY (SPDR S&P 500 ETF Trust) and VOO (Vanguard S&P 500 ETF) is one such decision that has the potential to significantly impact your portfolio.

It’s critical to comprehend the distinctions between these two well-known exchange-traded funds (ETFs) as the financial world gets more complicated.

Here are the reasons I’ve decided to transition from SPY to VOO:

Table of Contents

Lower Expense Ratio

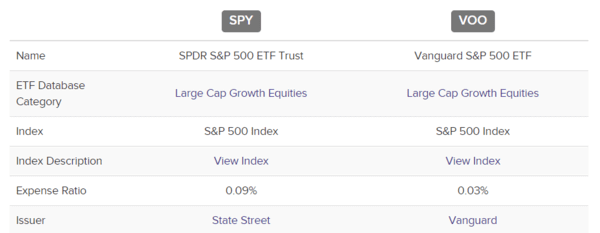

When it comes to choosing between SPY and VOO, you might find yourself facing a pleasant dilemma. Both of these exchange-traded funds (ETFs) have portfolios that closely mirror each other, and either choice is a solid one for your investment journey. However, if you’re thinking long-term, VOO stands out as the frontrunner due to its remarkably low expense ratio of just 0.03%, in contrast to SPY’s slightly higher ratio of 0.0945%. This seemingly minor difference can have a significant impact on your overall returns over time.

Let’s break it down with an example: If you were to invest $100,000 in VOO, the annual fees you’d incur, thanks to that 0.03% expense ratio, would be a modest $30 (0.03% of $100,000). On the other hand, if you chose SPY with its 0.09% expense ratio, you’d be looking at $90 in annual fees (0.09% of $100,000).

The divergence between these expense ratios is $60. At first glance, this may not seem substantial, but it accumulates more rapidly than you might think, particularly for investors with a long-term perspective. Over a decade of holding your investment, VOO’s lower expenses would save you $600, and over two decades, your savings would grow to a noteworthy $1,200. Furthermore, let’s not forget the potential for growth by applying an average return of 7%, adjusted for inflation, to the amount saved.

Tracking the same index

Both SPY and VOO share a common focus: they track the S&P 500 index. This means that, in essence, they offer highly similar investment focuses. For those who favor diversification over speculation, this harmonization of objectives is an advantage. It simplifies the investment process, making it akin to a “set it and forget it” approach.

In the world of investing, it’s often the nuance, like expense ratios, that can make a considerable difference in your long-term financial outcomes. So, when you’re deciding between SPY and VOO, remember that they may be two sides of the same coin, but that 0.03% difference in expense ratios can make one side shine brighter in the end. As you embark on your investment journey, keeping an eye on these seemingly small details can lead to significant gains over time.

Vanguard’s Reputation

For me, it was the low fees.

The Simple Life Path to Wealth is the one book I would suggest reading in order to understand why I made the decision to transition from SPY to VOO. You’ll learn why so many investors favor Vanguard index funds and exchange-traded funds (ETFs) by reading that book. Notice: Not every ETF or index fund is created equal.

Conclusion

The decision to transition from SPY to VOO serves as a reminder to continue learning when it comes to investing. Making decisions that align with your own goals and circumstances is crucial, whether it’s switching to a different fund or modifying your whole strategy. The ability to evaluate and adjust is a crucial skill in the pursuit of financial success, and switching to VOO implies a thoughtful step in the direction of a more promising future.

That being said, I will now begin allocating my investment to VOO and leave SPY alone.

**Valuable Resources I Use Daily:

Empower offers a free account to assist you in managing your net worth and investment portfolio. Your asset allocation and portfolio performance are so obvious and easy to grasp that I can't get enough of them. It's an excellent tool for anyone keeping track of their investments.

Robinhood is a platform that does not charge commissions. You can start investing with as little as $1 in stocks, ETFs, and REITs. It's simple to operate and navigate. Sign up now to receive a free stock.

Gio founded TheGrowthFocusedGuy in January 2020 because he was fed up with debt.

His mission is to document his journey to Financial Independence in order to motivate and inspire others to get out of debt and begin building generational wealth.